A creditor who obtains a judgment against you is the "judgment creditor." You are the "judgment debtor" in the case. A judgment lasts for 12 years and the plaintiff can renew the judgment for another 12 years.

What actions can the judgment creditor take to collect?

If you do not pay the judgment or work out arrangements to pay, the judgment creditor may take the following actions:

Collect Information | Lien on Property | Garnishment of Wages

Garnishment of Bank Account | Tell the Court that the Debt is Paid

Collect Information

If the court enters a money judgment against you, the plaintiff can request information from you about your employment, assets, debts, income and expenses. In small claims cases, the plaintiff cannot request this information. Small claims are cases for 5,000 dollars or less.

- You may receive the form, Judgment Debtor Information Sheet (CC-DC-CV-114) from the judgment creditor. If you do not respond to the form in time, you may have to answer Interrogatories (written questions answered under penalty of perjury), appear in court to answer the questions (Oral Examination), or both. This form cannot be used to enforce a small claims judgment. If you receive this form in a small claims case, contact a lawyer.

- Complete the entire information sheet and return it to the judgment creditor (plaintiff) along with the documents listed on the form. Send the information sheet to the plaintiff no later than 30 days after it was mailed or delivered. DO NOT SEND THE FORM TO THE COURT.

- If you do complete the form and send it back within 30 days, you won't have to answer Interrogatories or appear for an Oral Examination for at least one (1) year from the entry of the judgment, unless the court orders otherwise for a good reason.

- If you receive a summons from the court and do not appear, the court may issue a body attachment and it may lead to your arrest.

Lien on Property

- What is a lien (pronounces "LEEN")? A lien is a lawful claim against property that guarantees payment of a debt. If the debt isn't paid, the creditor may be able to seize the property. The creditor may also be able to sell the property to satisfy all or part of the debt.

- A judgment for money is a lien for the amount of the judgment and post-judgment interest.

- In Baltimore City, the court will record the lien without a request. In all other counties, the creditor has to file a request to record the lien in the circuit court. (Form DC-CV-035, Notice of Lien)

- If you own property, the court will send the notice of the lien to the circuit court where you have property. The circuit court will record or "attach" the lien to your property to give notice that you owe money to the plaintiff. The lien may affect your ability to sell your property or get a loan.

Garnishment of Wages

- The creditor can file a request to have your employer to withhold part of your wages. Wages will be withheld until you pay the judgment in full.

- You have the right to contest the garnishment. Use the DC-002, Motion to explain your defense or objection.

- Once a garnishment begins, the creditor must send you a statement of your payments. The creditor must send the statement within 15 days after the end of each month.

- An employer cannot fire you because your wages are being garnished for any one debt within a calendar year.

Are there any limitations on how much a creditor can collect from the debtor's paycheck?

A creditor may not garnish more than 25% of your wages per pay period. For individuals earning minimum wage or near minimum wage, you must be left with an amount equal to 30 times the Maryland minimum hourly wage.

Garnishments of Property and Bank Garnishments

A judgment creditor may ask the court to seize your property in order to pay a debt for which the court has issued a judgment. Garnishments of property are most often directed at bank accounts. If your property other than a bank account is being garnished, speak with a lawyer right away.

How Do Bank Garnishments Work?

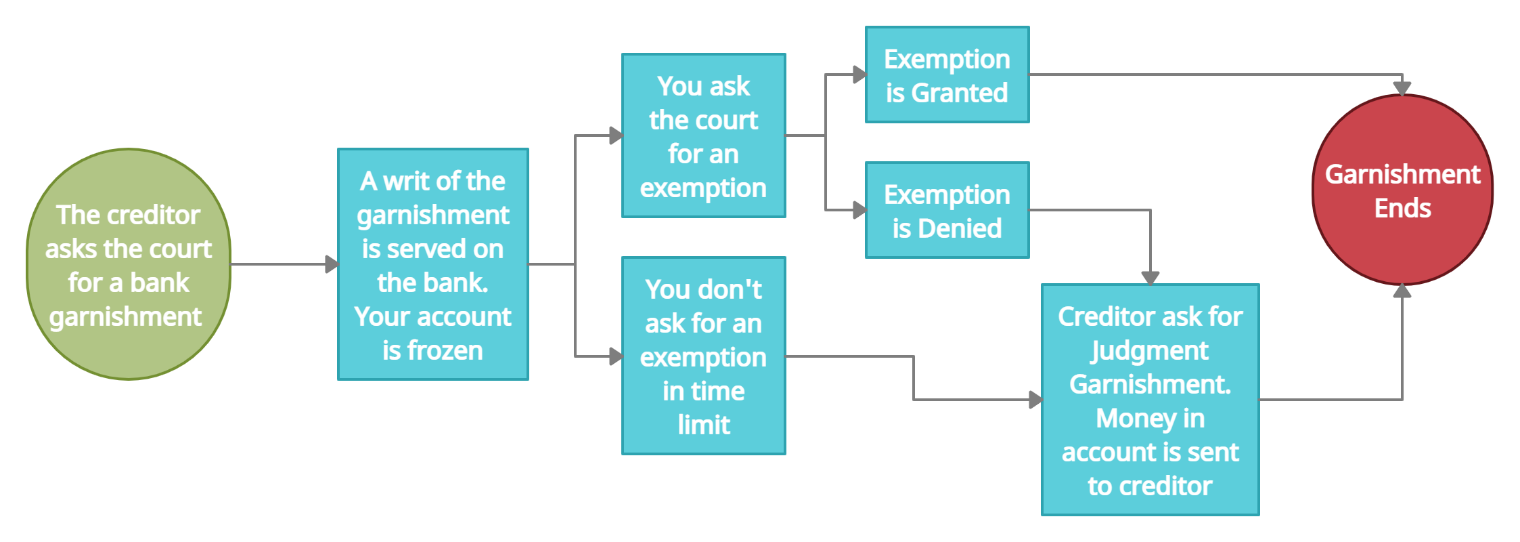

- First, the judgment creditor will ask the court for a bank garnishment.

- A writ of the garnishment is served on your bank. The bank must then freeze the money in your account up to the amount of the judgment including costs and interest. You will not be able to withdraw this money. Any money deposited into the account (such as direct deposit) will be frozen up to the amount of the garnishment.

- The bank will mail all parties and the court a Confession of Assets (DC-CV-61). It will state how much money (if any) is being held by the bank.

- You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

- If you ask for an exemption and it is granted, the bank will no longer hold the exempted money for the judgment creditor. That money is protected from garnishment.

- • If you did not request an exemption or none of the exemptions apply to some or all of your money, the judgment creditor may request Judgment Garnishment (DC-CV-062). This means that the court will direct the bank to give the money up to the judgment amount to the judgment creditor.

Bank Garnishment Timeline

What Can't be Garnished? (Exemptions from Bank Garnishment)

Money in a bank account may be protected from garnishment. This is called an exemption. Maryland law provides for an automatic exemption in the amount of 500 dollars. This means at least 500 dollars in your bank account will be protected without you taking further action.

For other exemptions, file a written request within 30 days of when the writ of garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036). When the court grants an exemption, the exempted money will not be removed from your account. However, the money in your account may be frozen until the court rules on any exemption requests or the creditor’s request to remove unexempted money from your account (request for Judgment Garnishment).

When will the court grant an exemption? – In order for the court to grant an exemption for a bank account you must state a legal reason from state or federal law for the exemption. Below are listed the most common legal reasons for the court to grant an exemption. If you aren’t sure whether you qualify for an exemption, speak with a lawyer.

Under Maryland law you can request an exemption of up to $6,000 for any reason. See Maryland Annotated Code, Courts and Judicial Proceedings § 11-504(b)(5).

Other grounds for an exemption are based on where you got the money. You may qualify for an exemption if the money in your bank account came from one of the following sources:

- Social Security benefits (Disability and retirement)

- Veterans benefits and other federal benefits listed here.

- Child support

- State public assistance benefits (SNAP, TCA, etc.)

- Qualified retirement benefits (401k, IRA, pensions)

- Workers Compensation

- Unemployment Insurance

- Alimony

In some cases, the bank may decline to freeze legally protected funds from the above list. When this happens, the bank will notify you and the judgment creditor that the money is protected on the Confession of Assets (DC-CV-061). When the bank does not apply an exemption automatically you may still request exemption yourself from the court.

One more common reason an account may be exempted is when the bank account is considered spousal property. You may claim the spousal property exemption if the account being garnished:

- Is in the name of two persons who are married; and

- The bank account was opened before the judgment was entered.

Requesting an Exemption

Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036). Here are a few tips for completing the form:

- The form asks you to describe the property you wish to have released from garnishment. When the property is a bank account, list the name of the bank, type of account (checking, savings, etc.), and the last four digits of the account number.

- If you are requesting to exempt up to $6,000 as permitted by Maryland Law, check the box “the Judgment Debtor elects to exempt property to the value allowed by law.”

- For most other exemptions listed on this page, select the “other” box and write in the reason the property is exempt. (i.e. “the money in the account is social security disability benefits.”)

Submit the form to the court within 30 days of when the bank was served with the garnishment. Be sure to serve a copy on all other parties involved in the case, including the bank. A judge will review your request. A hearing is sometimes scheduled to review the request. You must appear at a scheduled hearing or the exemption request may be denied.

Notice will be sent to inform you if the exemption is granted or denied. If the exemption is granted, then the exempted money in the account will not be removed from the account, consistent with the court’s order. If the exemption is denied, then the judgment creditor may request to take that money. If your exemption request is granted, the judgment creditor may still seek to remove any money that is not exempt.; only exempt money is protected. If the creditor requests the removal of money in the account, they will request Judgment Garnishment (DC-CV-062). Money in the account may then be released to the judgment creditor and applied to the judgment.

What happens when the debt is paid? (Md. Rule 3-626)

When you pay the debt, the creditor must notify the court and send you a copy of the notice of satisfaction. The creditor can use form Notice of Satisfaction (DC-CV-031), for this purpose. KEEP A COPY FOR YOUR RECORDS.

If the judgment creditor does not file a Notice of Satisfaction, you can ask the court to issue an order. Complete and file form, Motion for Order Declaring Judgment Satisfied (DC-CV-051). A copy of the motion must be served on the creditor by certified mail return receipt requested, sheriff, or private process server. You may be eligible for the money you spent to get the order, including reasonable attorney fees.

Resources

Help is available at the Maryland Court Help Center for civil cases, including consumer matters like debt collection and credit card cases, and small and large claims.

Dealing with Debt Collectors:

If you still want a lawyer:

- Private Lawyers: Local Bar Association Referral Services

- Free or Low-cost Legal Help Programs: Directory of free and low-cost legal service providers